This week, corporate executives continued to belt out the warnings about the rising prices they are seeing. Proctor & Gamble CEO, Andre Schulten said the increase in commodity costs was one of the largest he had seen in his career, and he expected the pressure to grow. John Hartung, CFO of Chipotle, flagged rising labor costs as a potential risk to profit margins, and he predicted, “Everybody in the restaurant industry is going to have to pass those costs along to the consumer.” Whirlpool will raise prices 5-12% to offset what it expected to be a $1 billion hit this year from higher input costs. Honeywell commented on rising costs, “We knew it. We see it. It’s real.” Too bad that neither Fed’s Jay Powell nor anyone in the Biden administration can see it or realize its significance.

B of A tracks what they call “mentions of inflation” on corporate earnings conference calls. They show that these mentions are up 300% over the past year, which is, by far, a record for as long as they have been tracking this data, since 2003. They also show a direct relationship between these mentions and the (CPI) Consumer Price Index (slide 1).

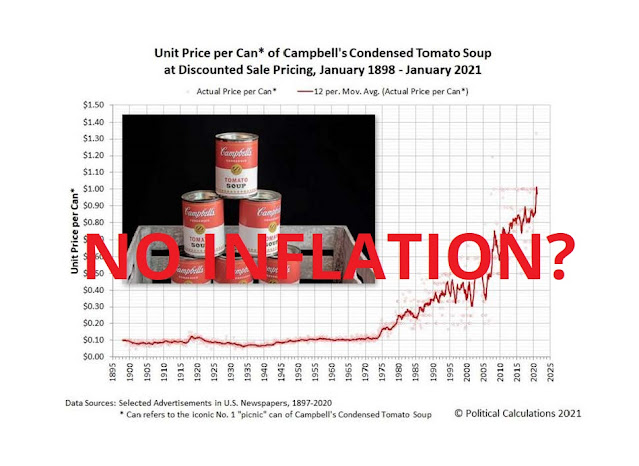

This indicator signals much higher prices to come for Main Street. Fed Chair Jay Powell continues to maintain that these price increases will be transitory. Do any of you believe that these companies are going to lower prices after this supposed transitory period? No, instead, most of these price increases will be permanent, and prices will continue to move even higher. As I’ve said repeatedly, the higher

prices that we now must pay on the things that we are buying represent the bill being levied on us for the record government spending spree. It is not free. We are paying for it directly in the form of higher prices on everything from Kleenex and gasoline to new homes. What this really means is that our money buys less; it is worth less. This is because the supply of dollars has been increased by about 70% in the past year, which renders all dollars in circulation as having less value. The Fed has made us poorer to the extent that our money can no longer buy as much as it could a year ago. And it is going to get worse. Inflation is a hidden tax. As a famous economist said, “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all of the hidden forces of economic law on the side of destruction, and it does it in a manner which not one man in a million is able to diagnose.” Unfortunately, what Jay Powell is really good at is debauching the currency; he should not be fawned over as a hero for simply printing money in an effort to bail out the economy after the pandemic.

The government’s own preferred measure of rising prices, the Personal Consumption Expenditure Price Index, is beginning to reflect a surge in prices vs. the milder increase in prices that followed the government spending and money printing in 2009 in their effort to bail us out from the bursting of the housing/mortgage bubble (slide 2). You can see that prices are rising far faster now than they did in 2009-2010. Why? Not primarily because of pent-up demand and bottlenecks, but because the Fed increased the money supply by more than triple the rate of the increase of that in 2009-2010 (slide 3).

Why print so much money? The main reason is to pay for the massive government spending (slide 4). Government spending is nearly 35% of GDP, while it peaked at 25% of GDP during the housing bubble bailout. The difference is staggering as you can see on the slide.

As you know, the initial effect of the money-printing bonanza is to push up stock and real estate

prices—which makes all of us feel good and wealthier (slides 5-8). The problem is that the aftereffects are to push up prices on Main Street which we are just beginning to experience in earnest. In effect, this is just the second phase of our money losing its value. We can buy fewer shares of stock in a given company, less house for our money, and often with a lag, less at the grocery store for a given amount of spending. The process of the dollar losing its purchasing power began with the creation of the Fed in 1913, and under its stewardship the dollar has lost 95% of its value in terms of its purchasing power of goods and services. The dollar has lost over 99% of its purchasing power against gold, which of course was the basis of our money before the Fed was established. Keep this abysmal track record in mind when you hear Jay Powell drone on about the current surge in prices as being transitory. To the contrary, the relentless rise in prices that we see over the long pull is wired into the way the government pays for a large part of its spending; it simply prints the money.

As you can see from the slides on the valuation of stocks, residential and commercial real estate, the Fed’s easy-money policies have pushed the prices of these assets into the stratosphere. The high prices that one must pay makes investing in most of these assets imprudent for the long-term investor at the present time. One could speculate in these assets with the hope of buying and then hoping to be able to flip them to someone else at a higher price before the bubble bursts. I think a better strategy is to wait patiently until the bubble pops, which will lead to lower prices at which time one can make more sensible investments, and even find bargains. I employed this approach during the last two bubbles, the dot-com and housing bubbles, and as they burst, we were able to make many good buys at very low prices. I expect similar opportunities in the future.

Long-term interest rates rose again this week, and as you know, I expect rising long-term interest

rates to pop the current, colossal bubble. While long-term interest rates are still very low historically, the Fed’s inflationary policy has caused them to rise sharply over the past 9 months (slides 9-10). Due to the enormous amounts of money already dumped into the economy, and Jay Powell’s future intentions as reflected by his oft-repeated statement that he made again this week, “It is not time to even think about tightening monetary policy,” the Fed has no easy exit. I expect much higher long-term interest rates.

These rising rates are already beginning to bite the stock market. The go-go stocks in the technology space, e.g., the companies that claim to be associated with the cloud in computing, are struggling (slide 11). And, as I’ve noted in past letters, corporate insiders continue to unload shares of stock in their own companies at a record pace, as they sell to the Reddit crowd and others who are frantically chasing the stock market higher (slide 12). In light of the Berkshire Hathaway annual meeting to be livestreamed tomorrow, it is helpful to heed Charlie Munger’s warning that he gave in January about today’s market environment: “You don’t get rich by paying high prices for stocks in the middle of crazy, speculative booms.”

Given that the tide has turned sharply on long-term interest rates, I’ve never been more optimistic that the bubble is nearing its end. Rising long-term interest rates are the direct result of the Fed’s reckless policy. What seemed to be a panacea, printing money, which helped to create the bubble will turn out to be the cause of its demise. Interest rates will continue to rise as bondholders seek to protect themselves from the watering down of the money in which they will be repaid. As I noted in a prior letter, rising interest rates have caused the bursting of every Fed-induced bubble from the great stock market boom in the 1920s to the more recent dot-com and housing bubbles.

The information in the blog does not constitute an offer

to sell securities or a solicitation of an offer to buy securities. Further,

none of the information contained on this website is a recommendation to invest

in any securities.

Comments